Does The Market Care About Your Feelings?

Since the 1970s, economists have measured how consumers are feeling about the financial environment, by asking five questions. How would you answer these today if they were asked of you?:

- “Would you say that you (and your family living there) are better off or worse off financially than you were a year ago?

- Now looking ahead–do you think that a year from now you (and your family living there) will be better off financially, or worse off, or just about the same as now?

- Now turning to business conditions in the country as a whole–do you think that during the next twelve months we’ll have good times financially, or bad times, or what?

- Looking ahead, which would you say is more likely–that in the country as a whole we’ll have continuous good times during the next five years or so, or that we will have periods of widespread unemployment or depression, or what?

- About the big things people buy for their homes–such as furniture, a refrigerator, stove, television, and things like that. Generally speaking, do you think now is a good or bad time for people to buy major household items?” (Source: sca.isr.umich.edu)

When you read these questions today, can you see how they could be answered negatively? A lot of the news is bleak: rising interest rates, inflation, gas prices, volatile markets, and the war in Ukraine, etc. People are generally pessimistic; it’s no surprise that the answers to these questions reflect that right now. Overall, people just don’t feel great about their financial condition, and the financial condition of the country.

But what does this mean for the patient investor? (Hint: there’s hope)

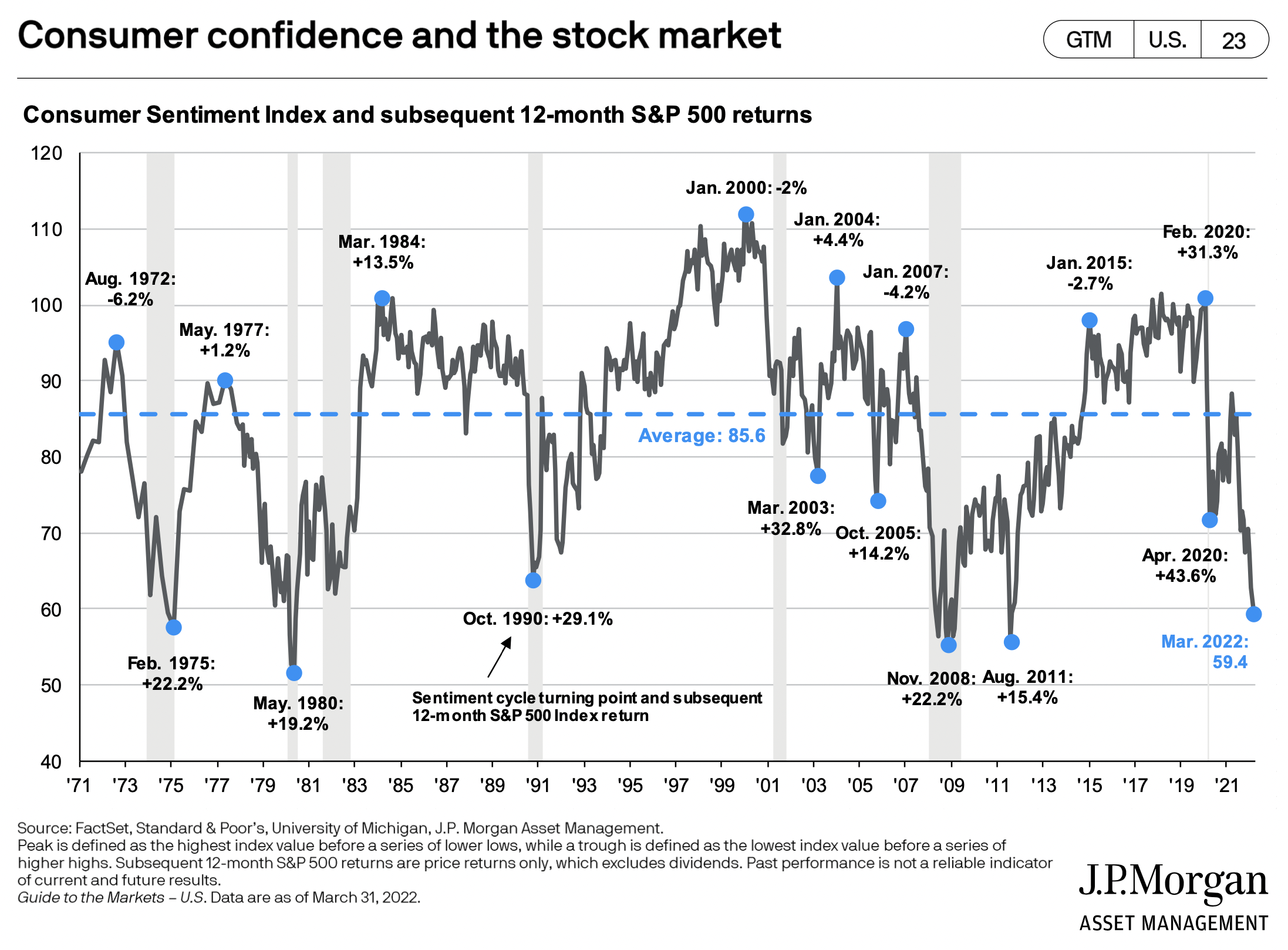

J.P. Morgan does a nice job of comparing the information from this survey (dubbed “consumer sentiment”), with stock returns (the S&P 500) over the next year (see the chart below). What does it show? After eight of the lowest readings (when people feel the worst), each of those inflection points was followed by a very strong one-year period for stocks.

One of the best examples of this was April 2020, when we were still in the early stages of the pandemic. This survey was given – responses naturally reflected a below average reading – and after that, the market went up by 43.6% over the next 12 months.

When people feel the worst, stocks very often have above-average returns over the subsequent year.

In other words, the market, unfortunately, usually doesn’t care about how people are feeling. This isn’t a guarantee, and it certainly isn’t a trading strategy. But we would say the odds are in our favor to not act hurriedly or rashly with our investments when the mood is sour. See for yourself by clicking on the image below. The blue dots represent how consumers are feeling at that time (higher=higher sentiment and lower=lower sentiment), and the percentage after each date represents how the market did in the next 12 months (click to enlarge):

So the market may not care about your feelings, but we do. If any of the last few month’s volatility or financial news bothers you please reach out. We’d be happy to discuss any aspect of your financial plan or investments with you.

In the meantime, we hope you’re enjoying the beginning of Summer.

Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing anything in this newsletter.

Posted by: