Shoes and Unexpected Upturns

There’s an old story that I love about two shoe salesmen that are sent to Africa by the company they work for to review the potential growth opportunities in this new land. Upon returning, one of them has sour news. “No one has any shoes,” he despondently reports. The other salesman, however, has a different viewpoint and exclaims “Great news! No one is wearing any shoes!”

With a return of -4.9%, the month of January was the ninth lowest on record for the S&P 500, dating back to 1926. So far in February, the index has retracted by another -4.5% as of this writing. The perspective that we have during times like these can have an impact on how we feel about our money and possibly even how we invest. The urge to do something to take advantage of volatility or to try and avoid more potential loss isn’t just limited to the average investor. There are also many advisors that attempt to weave and dodge during times like these. This is usually hidden under the guise of an expert money manager working on your side to attempt to stay ahead of the markets. Unfortunately, the end result is that although the investor may feel better (ie: “my advisor is really smart, and working hard for me by making changes now”), the reality is that they will most likely achieve poorer results than if they had simply been patient with a well-diversified and low cost evidence-based portfolio (and rebalancing when needed).

Not only is it difficult to feel better about the market when we have recently experienced lower market returns, we may also have a tendency to think that since it has gone down, it’s going to continue in that direction. Behavioralists call this “recency bias,” which reinforces the feeling that the market will continue to move in it’s most recent direction. But what can history teach us about times like these? It might surprise you that markets often provide “premiums” or better-than-average returns in short bursts, shortly after a challenging downturn. Let’s look at the evidence, and see if it can help us to practice a “glass half full” mentality with our portfolios.

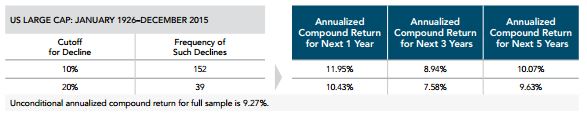

Below is a chart that represents all prior 10% “corrections” and 20% “bear markets” since 1926. Next to each of these are the frequency of such declines (note how many of these we’ve had in history!). Next, in blue the data shows the annualized returns over the next 1, 3, and 5 year periods:

As you can see from the data, the average returns for the periods leading out of the downturns were highly positive. So while downturns are never fun, this can be another reminder that for the equity side of a portfolio disciplined investors can be rewarded for the short-term risk of the markets. While there are no guarantees about how it will look coming out of this recent market drop (whenever that might start), history can serve as a guide and can help us to stay disciplined, and dare I say give us reason to be optimistic, when we most need it.

Source: Dimensional Fund Advisors

Sketch: Copyright 2013, Carl Richards, Behavior Gap

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. There is no guarantee an investing strategy will be successful. All expressions of opinion are subject to change. This content is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Posted by:

Pete Dixon, CFP®

Partner and Advisor