If You Ever Needed More Evidence To Properly Diversify…

We’ve said it before. There is nothing better than seeing a few concise, clear pictures that demonstrate (again) why as investors we follow the path we do. Dimensional Fund Advisors (DFA) recently came out with a piece that may help you to remember what we absolutely believe to be true. That is (in their words):

- Returns can vary sharply from one period to another

- Holding a broadly diversified portfolio can help smooth out the swings, and

- Focusing on known drivers of higher expected returns can increase the potential for long-term success

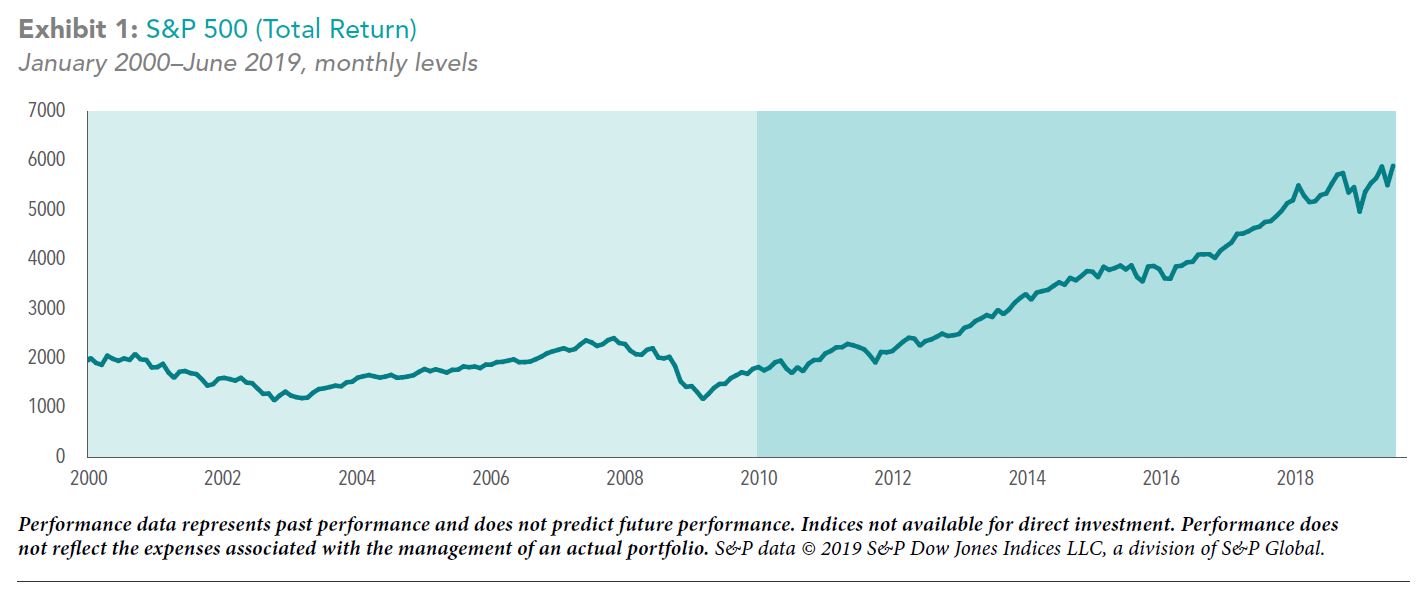

Reminders like this can also help us to answer certain questions we should naturally have from time to time. Questions such as “why would I continue to hold an investment that (in the short-term) has simply stunk?” To understand this more, let’s first start by looking at US Stocks (S&P 500) in the first decade of the 21st century (2000-2009) versus the second (2010 until June 2019). Note that you can click on each image to see a larger view:

If you’re like me, you may be glad that US Stocks are held in portfolios in some way, given their run over the last ten years. But what concerns me more is seeing that first decade (at left). What if US stocks go through a long period of time like this, and you’re just beginning to take income now from your portfolio? > SEE MORE

Posted by: