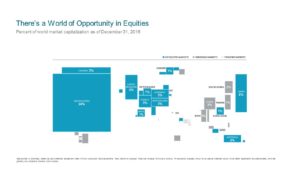

A World of Opportunities

How do we measure the world? Thinking only in terms of a country’s landmass can distort investment decisions. Directly comparing the markets of all nations produces some surprising results. Measures such as population, gross domestic product, or exports do not directly indicate the size or suitability of investments in a market.

This following illustration is one of our favorites and shows the balance of stock (equity) investment opportunities around the world. The size of each country has been adjusted to reflect its total relative “capitalization.”

Click here to view an enlarged version

Of course, the world is in motion—there is no fixed relationship between markets, and their proportion can change over time. Viewing the world this way brings the scope of diversification into a new light and helps clarify our allocation decisions for clients and ourselves.

A country’s equity market capitalization, or market cap, reflects the total value of shares issued by all publicly traded companies and is calculated as share price times the number of shares outstanding.

As always, if we can help clarify the globally diversified portfolio that you own (or if you’re not a client of Waypoint’s, the one that you probably should own), feel free to contact us.

Past performance is no guarantee of future results. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed on this or any other newsletter.

Posted by: