How Should We Rank The World?

Maybe you wonder as you peruse the global news headlines with your morning coffee: “What really IS inside my international investments, anyway?” Or “Did Turkey’s stock market really go up by 252% in 1999?” Okay, maybe that’s a stretch and you’re not wondering about that. While we certainly hope that’s not on your mind, we do think it’s interesting to peek into the world of our investments and point out the messy truths of international diversification–especially with this area of portfolios doing very well as we head to the end of the first half of the year.

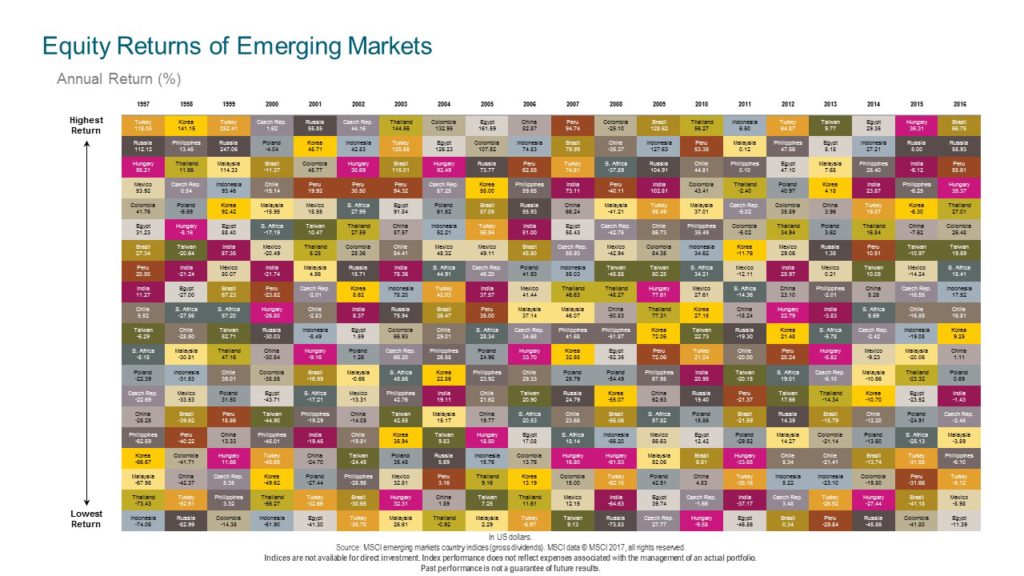

Let’s expand on last month’s post (here), where we reviewed the size (market cap) of markets worldwide. What if we could see the last 20 years’ annual performance, in order, for 41 various countries across the globe? More importantly, what can we learn from it? The picture below ranks the annual stock market performance for developed global markets (from highest to lowest) over the last 20 years:

Click here to view an enlarged image

What can we take away from an image like this, to help us to be better investors? First, there aren’t any recognizable patterns to discern which country will be the next winner or loser. Just as is the case with regularly changing or adjusting mutual funds or individual securities in an attempt to do better with our portfolios, it is a fool’s errand to attempt to time our exposure to countries as well.

Second, if we remain diversified and exposed to as much of these pieces at once, doesn’t it give us the best chance to capture returns wherever and whenever they occur? We then don’t have to worry about regret and missing out on what ‘could have been’. Of course, this also means that we always have some exposure to a poor performer, since that is the nature of diversification. Without guarantees of course, we believe (and see much historical evidence) that over time the whole is greater than the sum of its parts.

In addition to what we call the developed markets, there are those less developed countries, known as “emerging” markets, that represent approximately 11% of the world’s market capitalization:

Click here to view an enlarged image

We believe that proper exposure to both developed and emerging equities (relative to how much stock your portfolio calls for in the first place) is crucial to having a well-balanced portfolio to best meet your needs. And yes, while you can see that Turkey did go up by 252% in 1999, there is no way to tell where tomorrow’s winners will come from. Identifying your individualized, risk-adjusted portfolio to best suit your personal goals is still the most effective way to achieve real-world results.

Past performance is no guarantee of future results. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed on this or any other newsletter.

Posted by:

Pete Dixon, CFP®

Partner and Advisor