How Stocks Have Responded To Hikes In Fed Funds Rate

What a week. With the Federal Reserve increasing their “target” federal funds rate by a half-percent (the last time it was increased this much was the year 2000), the market responded with a wild ride up, followed by a large drop the next day.

In case you’re wondering how stocks typically respond to moves like this, we thought it would be helpful to look at some of the evidence. How has this worked out in the past, and how much should we worry?

As usual, we’d say that it would not be to your benefit to make any drastic moves based on short-term thinking. And based on what’s happened in the past, the odds wouldn’t be in your favor either.

The following piece (in the link below) put together by researchers at DFA tracks how US stocks responded to prior Fed moves like this.

We’ll boil it down to the highlights:

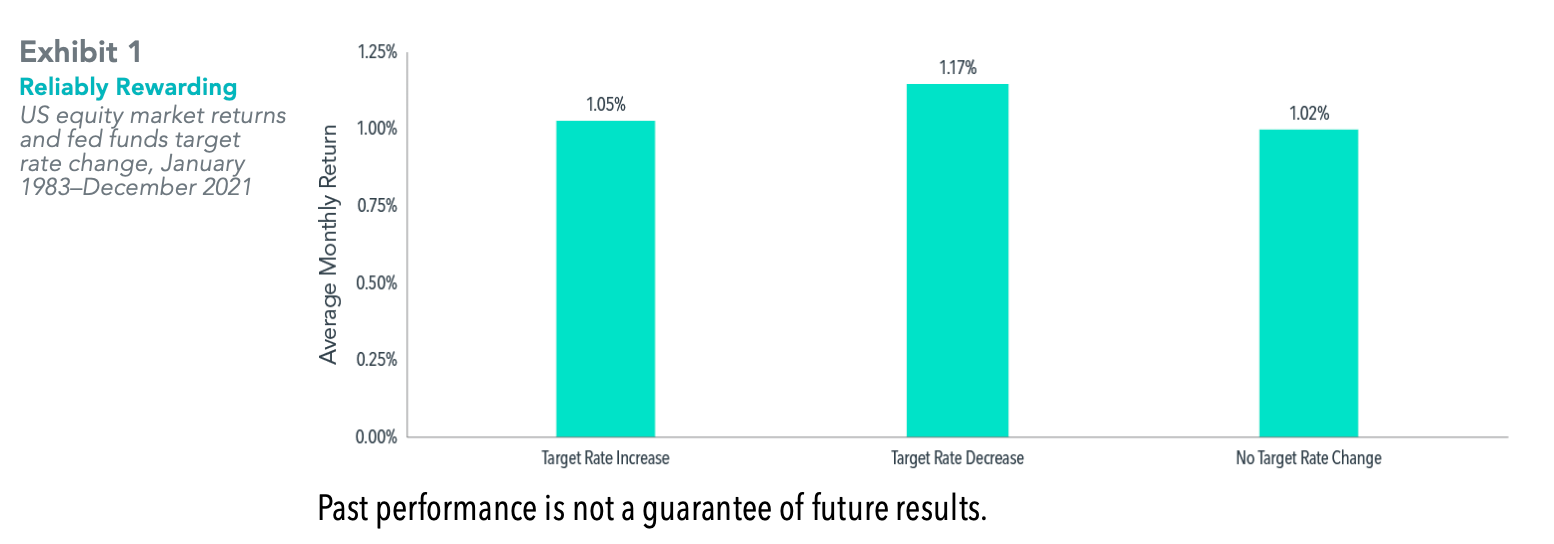

-Since 1983 (a period spanning 468 months), whether the Federal Reserve increased, decreased, or left rates the same, the average monthly return during that month was positive

-As rates were consecutively raised (which the Fed has indicated they could be doing across June and July – should economic conditions warrant doing so), average annual returns in US stocks during the following one, three, and five years were not only positive but very healthy.

For the full details, please click on the image below:

To be clear, this is not to say that the stocks won’t slide further from here, and is not to say that all is perfectly fine in the world (it never is).

It’s just a reminder that when the financial news starts to get really loud, we should remind ourselves of our planning and the importance of having a sound investment philosophy (that can be relied upon through all market conditions).

So if we can help you with revisiting your retirement/investment plan, please don’t hesitate to contact us.

Posted by: