A World of Opportunities

How do we measure the world? Thinking only in terms of a country’s landmass can distort investment decisions. Directly comparing the markets of all nations produces some surprising results. Measures such as population, gross domestic product, or exports do not directly indicate the size or suitability of investments in a market.

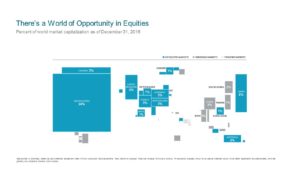

This following illustration is one of our favorites and shows the balance of stock (equity) investment opportunities around the world. The size of each country has been adjusted to reflect its total relative “capitalization.”

Click here to view an enlarged version

Of course, the world is in motion— > SEE MORE

Posted by:

Waypoint Wealth Management

Should We Track an “Index”, or Follow the Evidence?

Legend has it, a pharmacist named John Pemberton was searching for a headache cure when he tried blending Coca leaves with Cola nuts. Who knew his recipe was destined to become such a success, even if Coca-Cola® never did become the medicine Pemberton had in mind?

In similar vein, when Charles Dow launched the Dow Jones Industrial Average (the Dow), his aim was to better assess stock prices and market trends, hoping to determine when the market’s tides had turned by measuring the equivalent of its incoming and outgoing “waves.” He chose industrials (mostly railroads) because, as he proposed in 1882, “The industrial market is destined to be the great speculative market of the United States.”

Posted by:

Waypoint Wealth Management

There Is No Target

With everyone now reporting about how the next major level of the Dow Index is near, I just read a headline that the NEXT target is well beyond the one we may soon pass. It’s as if the selloff in the beginning of this year didn’t even happen (our post from January). Can we all just agree on something really important? There isn’t a target. When it comes to investing well over a lifetime, to provide for a family’s needs and possibly for generations after them, there isn’t any secret ‘level’ or ‘target’ to reach where we are then finished. > SEE MORE

Posted by:

Pete Dixon, CFP®

Partner and Advisor

Is Your Advice Good Enough?

In today’s climate of one-page financial plans, bargain-basement fund pricing and automated investment tools, you may wonder whether you need a living, breathing financial adviser.

We think you do, but with a twist. First, we need to redefine traditional financial advice – the kind that’s been delivered by those focused on issuing buy/sell recommendations, executing transactions, making you think they have the best investment product for you, and collecting their commissions. If that’s what you’re thinking of, you are correct. You don’t need that. You probably never did.

As we face continual changes with the markets, Social Security, taxes, etc., the welcome advances we referenced above are best thought of as augmenting rather than replacing the solid advice most investors still sorely need to see their way through to a rewarding retirement.

So, what is “good advice”? > SEE MORE

Posted by: