What Has Historically Followed A Time Like This?

Having patience can be challenging when recent downturns have occurred. But the reality is that some of the biggest innovations (and opportunities) arise out of difficult times. And when it comes to investing, all we have is what those opportunities might bring us in the future. This is why investing can be hard when focusing on short-term movements for your long-term retirement plan.

We can’t go back in time and change the past, but we can return to the evidence, and review what has occurred each time. And while not perfect or any guarantee, we can put the odds in our favor to grow over time.

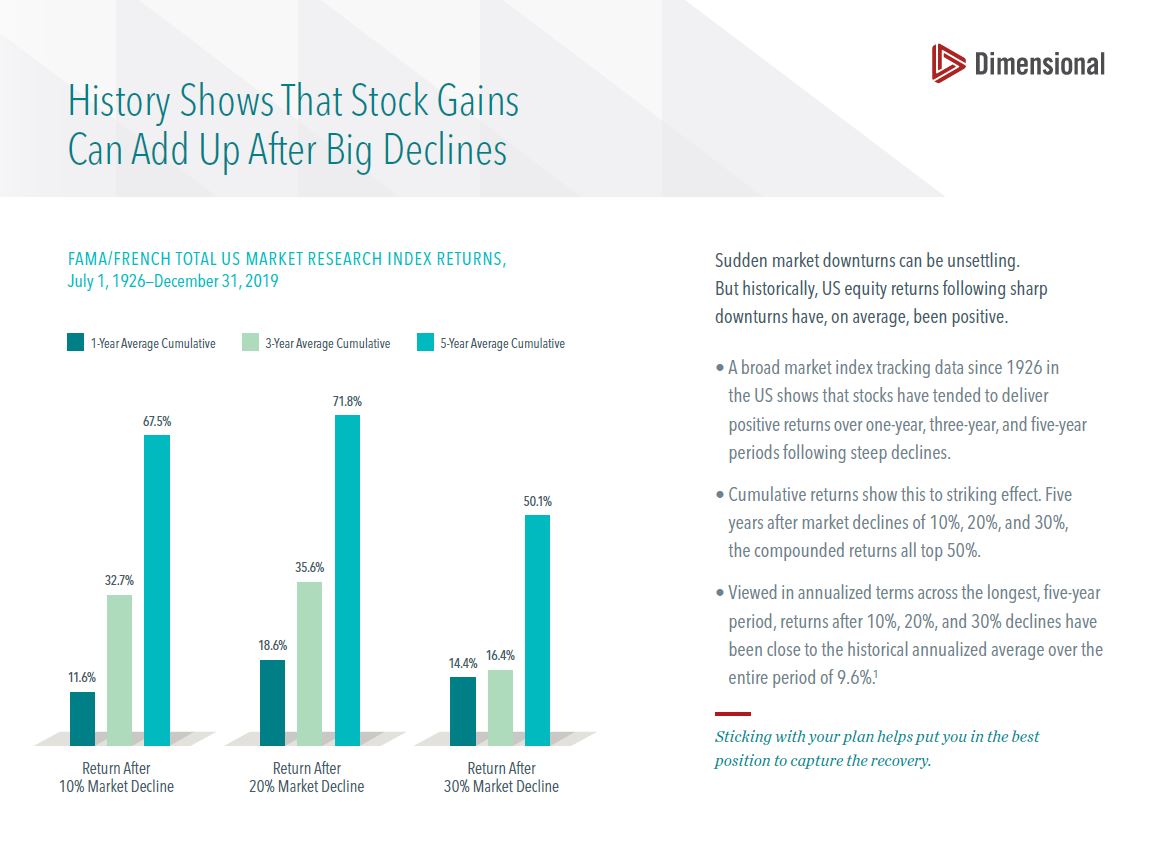

Our partners at Dimensional put this visual together (below) showing how returns have averaged coming out of downturns of -10%, -20%, and -30%. Please take a look as a reminder of how having a longer-term outlook has helped investors in times like these – to not only stay on course but also to be confident in what can lie ahead. And if you wanted more detail on this, be sure to click here to review a prior post of ours that breaks down each specific downturn and recovery.

See the piece from DFA, here:

Hopefully, as we go into the weekend this helps you to feel more confident about the future and investing, but please don’t hesitate to reach out if we can go over your specific situation in more detail.

Posted by: