What’s the Point of a “Point”?

We’ve often said that watching the market every day has little (if any) benefit to you as a long-term investor. However, we can’t help but hear or read headlines such as “Dow rallies 500 points” or “Dow drops 500 points.” These types of stock movement headlines may make little sense to some investors, given that a “point” for the Dow and what it means to an individual’s portfolio may be unclear. Also, events such as a 500-point move do not have the same impact on performance as they used to. With this in mind, let’s take a look at what a point move in the Dow means and the impact it may have on an investment portfolio.

Impact of Index Construction

The Dow Jones Industrial Average was first calculated in 1896 and currently consists of 30 large cap US stocks. The Dow is a “price-weighted” index, which is different than more common “market capitalization-weighted” (which is simply a product of its stock price and shares outstanding) indices.

An example may help put this difference in methodology in perspective. Consider two companies that have a total market capitalization of $1,000. Company A has 1,000 shares outstanding that trade at $1 each, and Company B has 100 shares outstanding that trade at $10 each. In a market capitalization-weighted index, both companies would have the same weight since their total market caps are the same. However, in a price-weighted index, Company B would have a larger weight due to its higher stock price. This means that changes in Company B’s stock would be more impactful to a price-weighted index than they would be to a market cap-weighted index.

The relative advantages and disadvantages of these methodologies are interesting topics themselves, but the main purpose of discussing the differences in this context is to point out that design choices can have an impact on index performance. Investors should be aware of this impact if they were to ever compare their own portfolios’ performance to that of an index.

Headlines vs. Reality

Movements in the Dow are often communicated in units known as points, which signify the change in the index level. Investors should be cautious when interpreting headlines that reference point movements, as a move of, say, 500 points in either direction is less meaningful now than in the past largely because the overall index level is higher today than it was many years ago.

For example, a 500-point drop in January 1985, when the Dow was near 1,300, equated to a nearly 39% loss. A 500-point drop in December 2003, when the Dow was near 10,000, meant a much smaller 5% decline in value. And a 500-point drop in early December 2018, when the Dow hovered near 25,000, resulted in a 2% loss.

How does the Dow relate to your portfolio?

While the Dow and other indices are frequently interpreted as indicators of broader stock market performance, the stocks composing these indices may not be representative of an investor’s total portfolio.

For context, the MSCI All Country World Investable Market Index (MSCI ACWI IMI) covers just over 8,700 large, mid, and small cap stocks in 23 developed and 24 emerging markets countries with a combined market cap of more than $50 trillion. The S&P 500 includes 500 large cap US stocks with approximately $23.8 trillion in combined market cap. The Dow is a collection of 30 large cap US stocks with a combined market cap of approximately $6.8 trillion (as of January 31, 2019).

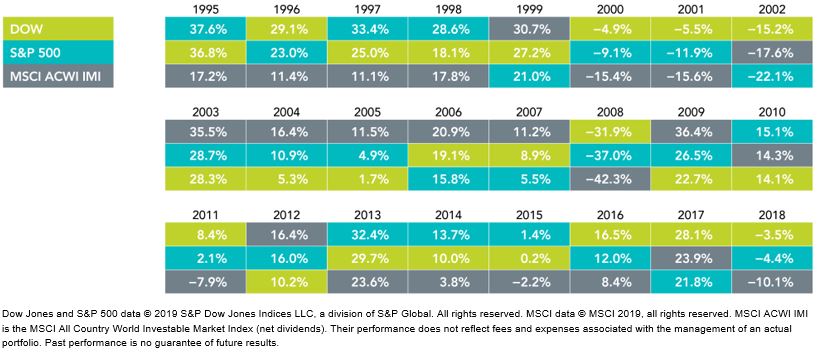

Even though the MSCI ACWI IMI, S&P 500, and Dow are all stock market indices, each one tracks different segments of the market, so their performance can differ significantly over time, as shown below. As you can see, Since 1995, the Dow has outperformed the S&P 500 and MSCI ACWI IMI by an average of 0.5% and 3.3%, respectively (based on calendar year returns). However, relative performance in individual years can be much different. For example, in 1997, the Dow underperformed the S&P 500 by 8.4% but outperformed the MSCI ACWI IMI by 13.9%.

Performance of MSCI ACWI IMI, S&P 500, and Dow by Calendar Year

It is also important to note that some investors may be concerned about other asset classes besides stocks. Depending on investor needs, a diversified portfolio may include a mix of global stocks, bonds, and any number of other assets not represented in a stock index. A portfolio’s performance should always be evaluated within the context of an investor’s specific goals. Understanding how a personal portfolio compares to broadly published indices like the Dow can give investors context about how headlines apply to their own situation.

We hope that reviewing this is a helpful reminder that news headlines are often written to grab attention, while there is usually more to the story. A headline publicizing a 500-point move in the Dow may trigger an emotional response and, depending on the direction, sound either exciting or ominous enough to warrant reading the article. However, after digging further, we can see that the insights such headlines offer may be limited, especially if investors hold portfolios designed and managed daily to meet their individual goals, needs, and preferences in a broadly diversified and cost-effective manner.

Source: Dimensional Fund Advisors LP. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their financial advisor prior to making any investment decision.

Posted by: