Understanding ‘Average’ Returns

The US stock market has delivered an average annual return of around 10% since 1926.[1] But short-term results may vary, and in any given period stock returns can be positive, negative, or flat. When setting expectations, it’s helpful to see the range of outcomes experienced by investors historically. For example, how often have the stock market’s annual returns actually aligned with its long-term average? > SEE MORE

Posted by:

Waypoint Wealth Management

Our Brain And Our Behavior, Part Three

Do you ever do something based on a recent experience, even though you know it might not be the best choice? Or do you ever think to yourself “you know, I’m a better driver than most”? How about watching the market’s movements and subtly measuring your diversified portfolio’s recent returns against a very narrow comparison such as the general market? If you’re like most of us and answered yes to any of these, we’re going to explore how these behaviors can potentially take us off track when it comes to our finances.

This is the final article in our three-part series, where we’ve been exploring the most common ways that our brains can be wired to help us in life—but also can hurt us as investors. > SEE MORE

Posted by:

Waypoint Wealth Management

Can Budgeting Actually Be Rewarding?

Many people view budgeting as a never-ending exercise in self-denial, characterized primarily by the word “no”. But it doesn’t have to be that way.

Instead, think about budgeting as the connective tissue between where your money is going this week, this month or even this year and the life in retirement you’re working toward. When seen in that light, budgeting can be remade into an affirmative tool, an integral part of a fruitful and constructive financial rhythm aligned with your values and goals. And regardless of where you are financially, consider this: Staying within the reasonable guidelines you’ve set with your budget is like saying “yes” to a fulfilling retirement.

Posted by:

Waypoint Wealth Management

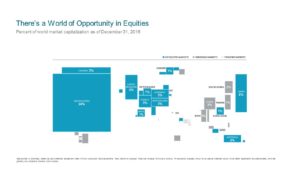

A World of Opportunities

How do we measure the world? Thinking only in terms of a country’s landmass can distort investment decisions. Directly comparing the markets of all nations produces some surprising results. Measures such as population, gross domestic product, or exports do not directly indicate the size or suitability of investments in a market.

This following illustration is one of our favorites and shows the balance of stock (equity) investment opportunities around the world. The size of each country has been adjusted to reflect its total relative “capitalization.”

Click here to view an enlarged version

Of course, the world is in motion— > SEE MORE

Posted by:

Waypoint Wealth Management

The Life You Chose

For some reason, a lot of people seem to be retiring lately. Over the last year, I and my partners Dave and Grant have helped numerous people make that leap away from their career, which for many can be a scary time. This is a very rewarding aspect of our careers as advisors. And it is also humbling and a great responsibility to advise those clients through this major event in their lives.

Once we get beyond the “X’s and O’s” related to the financial aspect of this planning, I can’t help but think about this next chapter for them and this word “Retirement.” At a recent class I attended, financial planner and Forbes columnist Carolyn McClanahan said something that we couldn’t agree with more. She said “let’s stop calling this Retirement, and start calling this just another transition in life that needs to be planned for.” To me, that opens up the realm of possibilities for the future rather than just contemplating what you would stop doing (which is the traditional way to approach retirement).

Posted by:

Pete Dixon, CFP®

Partner and Advisor