Our Brain And Our Behavior, Part One

If you have ever watched a youth soccer game, you’ve seen it. Basically, the players observe where everyone is headed (towards the ball), and follow suit. It doesn’t matter where the ball is located on the field or what position the child is in–they’re going after it with all their might! While it’s cute to watch, this cluster of uniformed chaos creates a hive of activity and works against them, making it difficult to move down the field.

In soccer, this behavior becomes less of an issue over time as the player learns the sport. In the world of personal finance, this type of behavior is referred to as herd mentality, a type of “behavioral bias”, and may not go away over time. And unfortunately, your own behavioral biases are often the greatest threat to your financial well-being.

Posted by:

Waypoint Wealth Management

Can Budgeting Actually Be Rewarding?

Many people view budgeting as a never-ending exercise in self-denial, characterized primarily by the word “no”. But it doesn’t have to be that way.

Instead, think about budgeting as the connective tissue between where your money is going this week, this month or even this year and the life in retirement you’re working toward. When seen in that light, budgeting can be remade into an affirmative tool, an integral part of a fruitful and constructive financial rhythm aligned with your values and goals. And regardless of where you are financially, consider this: Staying within the reasonable guidelines you’ve set with your budget is like saying “yes” to a fulfilling retirement.

Posted by:

Waypoint Wealth Management

Are You Prepared For The Next Correction?

If you enjoy a good read, we’d recommend Warren Buffett’s annual Berkshire Hathaway shareholder letters. While financial reports are rarely much fun, Buffett’s way with words never ceases to impress. His most recent 2016 letter was no exception, including this powerful insight about market downturns:

“During such scary periods, you should never forget two things: First, widespread fear is your friend as an investor, because it serves up bargain purchases. Second, personal fear is your enemy.”

This actually is a good time to talk about scary markets, since we haven’t experienced a severe one in a while.

Posted by:

Waypoint Wealth Management

A World of Opportunities

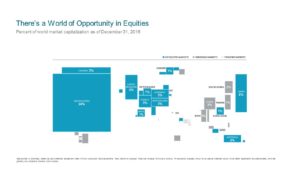

How do we measure the world? Thinking only in terms of a country’s landmass can distort investment decisions. Directly comparing the markets of all nations produces some surprising results. Measures such as population, gross domestic product, or exports do not directly indicate the size or suitability of investments in a market.

This following illustration is one of our favorites and shows the balance of stock (equity) investment opportunities around the world. The size of each country has been adjusted to reflect its total relative “capitalization.”

Click here to view an enlarged version

Of course, the world is in motion— > SEE MORE

Posted by:

Waypoint Wealth Management

Should We Track an “Index”, or Follow the Evidence?

Legend has it, a pharmacist named John Pemberton was searching for a headache cure when he tried blending Coca leaves with Cola nuts. Who knew his recipe was destined to become such a success, even if Coca-Cola® never did become the medicine Pemberton had in mind?

In similar vein, when Charles Dow launched the Dow Jones Industrial Average (the Dow), his aim was to better assess stock prices and market trends, hoping to determine when the market’s tides had turned by measuring the equivalent of its incoming and outgoing “waves.” He chose industrials (mostly railroads) because, as he proposed in 1882, “The industrial market is destined to be the great speculative market of the United States.”

Posted by: