What’s THE Most Important Thing You Can Do To Prepare For Retirement?

I was thinking about this question while reading an article a client sent to me. You can find the write-up here, and it’s a helpful “countdown to retirement” with many tips to consider as you approach retirement. As I looked through the list and thought about covering these issues with our own clients over the years, the question came to mind: what is the most important financial planning step you can take to feel great about your retirement plan?

It’s really a tough question since there are a lot of important issues to consider when “taking the leap” away from a career that you’ve had for so many years. Topics such as health insurance, do you have enough saved, are you invested properly, Social Security timing and others are obviously important to explore. There’s also the softer part of the equation: how will you spend and enjoy your time? Should you still work? How will you miss the social aspect of working and contributing?

But if I were forced to answer, what would I say is the most important question? That’s when I realized it’s the one that I have been recommending most lately when helping someone plan for retirement. It’s this simple question: how much do you need to live on (and how sure are you of that?)? > SEE MORE

Posted by:

Pete Dixon, CFP®

Partner and Advisor

Our Brain And Our Behavior, Part Two

Little did we know when we started this series last month that it would be announced the Nobel Prize in Economics would go to Richard Thaler. You may not have heard of him, but he is one of three behavioral economists who can claim credit to the award in the last fifteen years. If you remember being automatically enrolled in your company’s 401(k) program instead of signing up on your own, you can give thanks to Richard Thaler. He and many others are helping us to understand why we as humans do the things that we do so that we can better understand ourselves and hopefully improve our financial (and life) habits.

In this second of three articles (you can read the first one here), we’re exploring a few more of the most significant behavioral biases that Richard Thaler and others invested their careers to learn more about: hindsight, loss aversion, mental accounting and outcome bias.

Posted by:

Waypoint Wealth Management

How Should We Rank The World?

Maybe you wonder as you peruse the global news headlines with your morning coffee: “What really IS inside my international investments, anyway?” Or “Did Turkey’s stock market really go up by 252% in 1999?” Okay, maybe that’s a stretch and you’re not wondering about that. While we certainly hope that’s not on your mind, we do think it’s interesting to peek into the world of our investments and point out the messy truths of international diversification–especially with this area of portfolios doing very well as we head to the end of the first half of the year.

Let’s expand on last month’s post (here), where we reviewed the size (market cap) of markets worldwide. What if we could see the last 20 years’ annual performance, in order, for 41 various countries across the globe? More importantly, what can we learn from it? The picture below ranks the annual stock market performance for developed global markets (from highest to lowest) over the last 20 years:

Click here to view an enlarged image

What can we take away from an image like this, to help us to be better investors? > SEE MORE

Posted by:

Pete Dixon, CFP®

Partner and Advisor

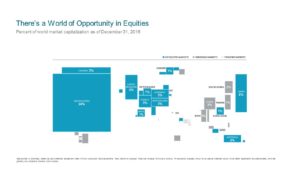

A World of Opportunities

How do we measure the world? Thinking only in terms of a country’s landmass can distort investment decisions. Directly comparing the markets of all nations produces some surprising results. Measures such as population, gross domestic product, or exports do not directly indicate the size or suitability of investments in a market.

This following illustration is one of our favorites and shows the balance of stock (equity) investment opportunities around the world. The size of each country has been adjusted to reflect its total relative “capitalization.”

Click here to view an enlarged version

Of course, the world is in motion— > SEE MORE

Posted by:

Waypoint Wealth Management

Your Investment’s “Survival Rate” And Why It Matters To You

Pretend for a moment that you have a mild medical condition and you visit your doctor for advice. After looking you over and running tests, the doctor provides you with a recommendation. There is a new drug available, and she would like to prescribe it to you. The only issue is that there is a 50% chance of survival over the next 15 years. Would you take that advice?

Would you be surprised to know that there is a similar chance of survival with investments? The mutual fund/ETF industry is continually creating new products for the investor. Some of them, like the ones that we use at Waypoint, are intended to benefit the investor with lower than average costs, more tax efficiency than many others, and a very high chance that they’re built to last. Unfortunately for many, many other investments the goal is to make money off of you rather than for you. > SEE MORE

Posted by: