10 Ways To Not Sweat The Small Stuff (With Investing)

If you pay attention to the news, you can’t help but hear about how volatility has increased recently. Overall, market temperatures have been so mild for so long, many newer investors have yet to weather a perfect market storm. Even if you have, you may have forgotten how challenging those times can be.

This worries us. Experience and evidence alike show us how severely bear markets test investor resolve. We’ve also seen how damaging it can be to act on rash fear rather than rational resolve during market downturns.

Let’s be clear – we’re not saying that we think markets are about to go south. But we do think that investors should be as informed and educated as possible. So just as we prepare for other emergencies in life, here are 10 timely actions you can take when financial markets are tanking … and, frankly, even when they’re not. > SEE MORE

Posted by:

Waypoint Wealth Management

A World of Opportunities

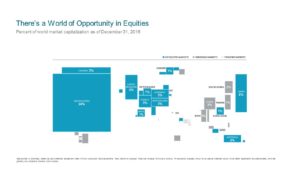

How do we measure the world? Thinking only in terms of a country’s landmass can distort investment decisions. Directly comparing the markets of all nations produces some surprising results. Measures such as population, gross domestic product, or exports do not directly indicate the size or suitability of investments in a market.

This following illustration is one of our favorites and shows the balance of stock (equity) investment opportunities around the world. The size of each country has been adjusted to reflect its total relative “capitalization.”

Click here to view an enlarged version

Of course, the world is in motion— > SEE MORE

Posted by:

Waypoint Wealth Management

What Are Three Things That Retirement Software Can’t Account For?

You’re getting ready to finally “retire”. We’ve run the numbers with you, looked at various calculations and determined when to begin Social Security. We looked at how your taxes will change, where that money will come from, and even how they will be paid. We’ve reviewed your allocation and strategy for portfolio income and how that fits into the plan. We told you that you are financially independent, that you won’t need to worry and you can enjoy this next chapter of life with full abandon.

But you’re still uneasy.

There is still something on your mind that’s worrying you. You’re comfortable with the financial aspects of this change, but you just aren’t sure how your life is going to look on the other side of this decision. > SEE MORE

Posted by:

Waypoint Wealth Management

Playing The “Winner’s Game”

Each year, our Director of Research at the BAM Alliance, Larry Swedroe, unveils what he believes are some of the most important lessons of investing. This month’s Viewpoints will highlight three of our favorites from the list. The full list of nine lessons can be found here, and is well worth the time to read.

It was tough to choose only three, as they’re all insightful. But here are Waypoint’s favorite three (okay, four) lessons from last year:

- Active management is a loser’s game:

Ouch. This might sound harsh. But more and more people are becoming aware of the evidence against investing based on opinion. More investors each year are realizing the challenges for active managers to keep up with (and outperform) the markets, after fees and taxes. At Waypoint, we’ve learned that as well and came to a point in our careers where we had to put ego aside and truly measure returns against an evidence-based portfolio. This is when we realized the importance of playing the winner’s game.

- So much of returns comes in very short and unpredictable bursts:

There is simply no better lesson for staying invested during challenging times. > SEE MORE

Posted by:

Waypoint Wealth Management

The Life You Chose

For some reason, a lot of people seem to be retiring lately. Over the last year, I and my partners Dave and Grant have helped numerous people make that leap away from their career, which for many can be a scary time. This is a very rewarding aspect of our careers as advisors. And it is also humbling and a great responsibility to advise those clients through this major event in their lives.

Once we get beyond the “X’s and O’s” related to the financial aspect of this planning, I can’t help but think about this next chapter for them and this word “Retirement.” At a recent class I attended, financial planner and Forbes columnist Carolyn McClanahan said something that we couldn’t agree with more. She said “let’s stop calling this Retirement, and start calling this just another transition in life that needs to be planned for.” To me, that opens up the realm of possibilities for the future rather than just contemplating what you would stop doing (which is the traditional way to approach retirement).

Posted by:

Pete Dixon, CFP®

Partner and Advisor