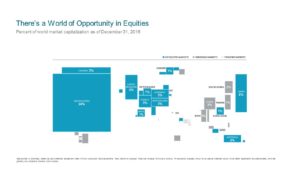

A World of Opportunities

How do we measure the world? Thinking only in terms of a country’s landmass can distort investment decisions. Directly comparing the markets of all nations produces some surprising results. Measures such as population, gross domestic product, or exports do not directly indicate the size or suitability of investments in a market.

This following illustration is one of our favorites and shows the balance of stock (equity) investment opportunities around the world. The size of each country has been adjusted to reflect its total relative “capitalization.”

Click here to view an enlarged version

Of course, the world is in motion— > SEE MORE

Posted by:

Waypoint Wealth Management

What Are Three Things That Retirement Software Can’t Account For?

You’re getting ready to finally “retire”. We’ve run the numbers with you, looked at various calculations and determined when to begin Social Security. We looked at how your taxes will change, where that money will come from, and even how they will be paid. We’ve reviewed your allocation and strategy for portfolio income and how that fits into the plan. We told you that you are financially independent, that you won’t need to worry and you can enjoy this next chapter of life with full abandon.

But you’re still uneasy.

There is still something on your mind that’s worrying you. You’re comfortable with the financial aspects of this change, but you just aren’t sure how your life is going to look on the other side of this decision. > SEE MORE

Posted by:

Waypoint Wealth Management

Playing The “Winner’s Game”

Each year, our Director of Research at the BAM Alliance, Larry Swedroe, unveils what he believes are some of the most important lessons of investing. This month’s Viewpoints will highlight three of our favorites from the list. The full list of nine lessons can be found here, and is well worth the time to read.

It was tough to choose only three, as they’re all insightful. But here are Waypoint’s favorite three (okay, four) lessons from last year:

- Active management is a loser’s game:

Ouch. This might sound harsh. But more and more people are becoming aware of the evidence against investing based on opinion. More investors each year are realizing the challenges for active managers to keep up with (and outperform) the markets, after fees and taxes. At Waypoint, we’ve learned that as well and came to a point in our careers where we had to put ego aside and truly measure returns against an evidence-based portfolio. This is when we realized the importance of playing the winner’s game.

- So much of returns comes in very short and unpredictable bursts:

There is simply no better lesson for staying invested during challenging times. > SEE MORE

Posted by:

Waypoint Wealth Management

My Love/Hate Relationship With ‘Past Performance’

“Past performance is not indicative of future results.”

Sound familiar? If you have invested in any regulated investment of any form, you have read or heard this phrase before. I have to be honest. Even as a professional advisor, when I read this and explain it to clients there is something about it that gets on my nerves. Don’t get me wrong, I’m not saying it’s untrue or that I don’t believe it. We don’t know what the future returns of our investments are going to be. We don’t know the exact short-term direction of an investment, and if anyone tells you that they do, you should find another advisor because you will be set up for failure.

If I really think about why this phrase annoys me, I think it is because I want to find some certainty with an investment’s outcome. Doesn’t everyone? > SEE MORE

Posted by:

Pete Dixon, CFP®

Partner and Advisor